http://play.simpletruths.com/movie/one-choice/?cm_mmc=CheetahMail-_-MO-_-09.17.12-_-ONCHmovie-USCAXX-&utm_source=CheetahMail&utm_campaign=ONCHmovie

|

I started Village of Life to help women change their lives and know that they can have something better. That is the one thing that I love most about this life is that we all have the freedom to choose our own path. No one can stand in our way unless we let them. We can decide to pull ourselves up by the boot straps and make our lives better and we can choose to help someone else do the same. Watch this short inspirational movie from Simple Truths, then leave your comment on what you want for your life and what one thing will you change to make it happen.

http://play.simpletruths.com/movie/one-choice/?cm_mmc=CheetahMail-_-MO-_-09.17.12-_-ONCHmovie-USCAXX-&utm_source=CheetahMail&utm_campaign=ONCHmovie

1 Comment

Not everyone has a family able to help them, but if your family is able to help you, would you let them? Allowing someone to help you takes a lot of humbling on your part. Below is a story that I am re-posting from LearnVest from a girl who had to humble herself after college by moving back in with her parents and what she learned from the experience. I wanted to share it with you because it is a helpful reminder that we can not always do it alone and it is ok to accept help from others. Even though I have been fortunate enough to never have to move back in with my mother, I have had to humble myself to borrow money from her after racking up over $50,000 in attorney debt from my divorce and long custody battle. As hard as it was to accept my mother's help, I have to admit that I would do it again to insure my children's safety and health.

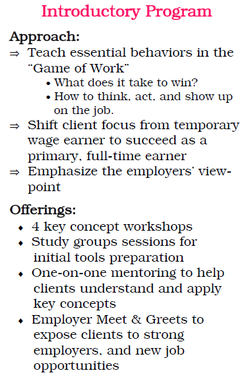

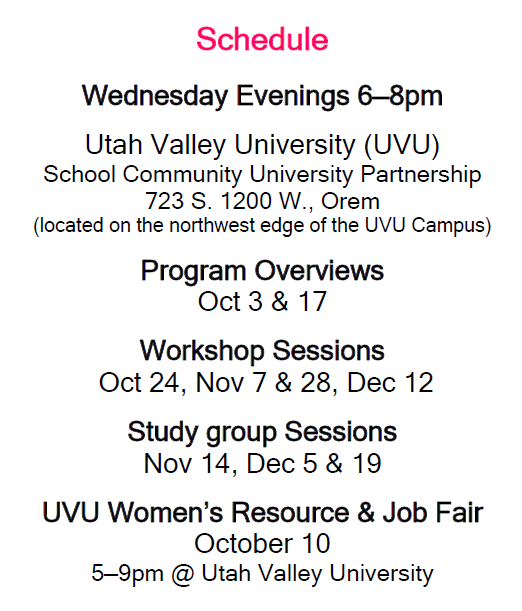

MONEY MIC: WHY I MOVED BACK IN WITH MY PARENTS by LearnVest According to a nationwide survey conducted by LearnVest and Chase Card Services, a division of JPMC, fully 40% of LearnVest readers have lived with their parents after age 21 and 7% of LearnVest readers live with their parents right now. So today, one 20-something shares her story of why she chose to move back home–and how she managed to move back out. Living at home after graduation was a reality I refused to accept. 2009 was a dismal year to graduate: the toughest job market in decades, with more than two million college grads unemployed and 80% of young adults living at home. Still, I refused to believe that I could be one of them. Up until that point, my life had followed a certain formula for success: Do your homework and study, and you’ll get into AP classes. Check. Play varsity sports and ace the SAT, and you’ll get into a good college. Check. Work hard and graduate with honors, and you’ll get a good job. Fail. I graduated from Washington and Lee University that June with $14,000 in student loans and zero job prospects in my chosen field: journalism. I accepted my diploma, packed up my parents’ car, and went right on back to my childhood home. Not in the Plan Growing up in suburban New Jersey in the shadow of the Big Apple, New York City always seemed intimidating. Then the summer before graduation, I won a scholarship to live there while interning at a national magazine. Immediately, I fell in love—with both city life and the magazine industry. After the internship, I sold my car, convinced that I would live in the land of subways after graduation (and relishing in the extra money my lack of insurance payments offered me). Then the economy took a turn for the worse. The tentative job offer from my internship vanished as the magazine instead made cuts. I doggedly refused to accept living with my parents as permanent. I got a job at a local day care to earn money and stay busy before I surely would land my dream job and move to the city. Slowly, though, reality started to creep in. Two weeks turned into two months. My naïve optimism waned. There I was, sleeping in my old twin bed in the shadow of the city where I wanted to live, making minimum wage and hitching rides around my hometown from my mom. I blinked hard and realized: I had hit rock bottom. No Coddling From the ‘Rents My parents were kind enough to not charge me rent while I was under their roof, mostly because I think they too saw my time home as temporary. Plus after I had just spent four years of college living seven hours away, they were honestly happy to have me home. But the truth was they had become empty nesters, and my coming home was effectively crashing their nest. As hard as moving back was for me, it was just as hard for them. While I had to adjust to being treated like a teenager again, they had to adjust to having an adult in the house. Living with them after college, I had the bad parts of being a kid again (curfew and chores) but not the good (when I came home from work, dinner was conspicuously missing from the kitchen table). With my dad away during the week for work and my older sister living on her own, my mom had no reason to make family meals anymore. The first time I asked what was for supper, she raised her eyebrows and laughed, “I don’t know, dear. What are you making for yourself?” My parents have always tried to teach me the value of a hard-earned dollar. They paid what they could of my expensive tuition and expected me to fund the rest. I worked after-school and summer jobs from age 14 to college and put $10,000 toward tuition by the end of my freshman year. Sure, I would have loved to move to New York right out of college. Believe me, it’s no fun to share a shower schedule with your mother. But I felt like I had no choice: I simply couldn’t afford to pay rent until I had a steady paycheck to sign over to a landlord. How This Affected Me Living at home did a number on my confidence. Facebook and I had a falling out because pictures of apartments and friends’ happy hours made me resentful—especially of those fortunate few whose post-graduate educations and rent payments were like an all-expenses paid vacation courtesy of mom and dad. (Something that is apparently all too common.) My parents wanted to help me get on my own two feet, but they weren’t about to go broke doing it for me. So I avoided gatherings where the inevitable “What are you doing?” question might be asked. College reunions? No, thank you. It was embarrassing enough to run into my ex-boyfriend’s parents in the supermarket and explain my “situation.” In my mind, it was less humiliating to job search in private than to admit my failure in front of others. Looking back, I shouldn’t have shied away from networking—plenty of 20-somethings were in the same boat as me. But I was fixated only on what I didn’t have. Hello, Reality After three months at home, my obstinate fixation on a dream job in the dream city started to subside. I was job searching daily and going on interviews, but to no avail. So while still living at home, I took a minimum-wage internship at a regional magazine. My commute and my $8-an-hour salary were next to nothing, so I figured I’d stay put until something better came along. Eight months in, I was promoted to a salaried position. The job wasn’t glamorous, but as part of a small staff, I learned quicker and wore more hats than I might have elsewhere. Meanwhile, I continued to work as a glorified babysitter at the day care a few nights a week at $8 an hour to supplement my income. Even with that, I was making under $28,000. I had no magic number in mind that I’d need before I moved out of my parents’ house, but I felt the freedom of living on my own was out of reach. Having $14,000 in student loans felt so crushing that it was a relief not to worry about rent or groceries. I consolidated my four loans into two monthly payments totaling around $200 a month, and gradually increased the payments as my savings account swelled. Since my main expenses at home were gas and social activities (hardly expensive in suburban Jersey, where a night out meant $1 PBRs at a local dive bar), I eventually managed to save close to $10,000. Then, as I approached my two-year anniversary of living with my parents, a friend transferred to New York for work and asked to be roommates. My biggest fear was moving out prematurely and having to return home with my tail between my legs. Even though I had saved up a chunk of change from my time at home, I wanted to keep it safe to help pay off my student loans instead of living off of it. But it felt like an opportunity was finally being handed to me. I couldn’t pass it up. Slummin’ It My first apartment was a dump located just across the river from New York, where the rent is cheaper. Our bathroom could only fit one person at a time, and my bedroom, the smallest of the three, was just big enough to house a desk, a small dresser and my very first queen-sized bed. When it rained, the skylight in the hallway leading to our unit became a waterfall, and in the fall, a family of mice decided to move in. But every teeny, tiny square inch of it was finally mine. At $875 a month, my rent was comparatively cheap. Still, it was a whopping 53% of my monthly take-home (and LearnVest recommends you only spend 50% of your income on all essentials, including rent, groceries, utilities and transportation). I should have budgeted before jumping in, but in my excitement, that fell to the bottom of my to-do list. Somewhere between outfitting the apartment, celebrating with friends over drinks and trying restaurants down the street, I emptied the $2,000 in my checking account within my first month living on my own. So I modified my spending. On Tuesdays when the office went out for lunch, I brown-bagged it at my desk. I kept the walls in my room bare for six months, rather than filling them with newly-purchased art. And I stopped buying clothing—even a $15 Forever 21 dress adds up when it becomes a regular cost. I also started to track every penny I spent to see where it was going—a habit I still have today (LearnVest has a free tool that can do it for you, too). Those first few months were hard, but I relished the independence of doing it on my own. Turns out that putting myself into an uncomfortable financial situation was just the push I needed. By the fall, I landed a new job, finally in the city at a national magazine with clout. I saw it as a compromise: The title was slightly lower, but the $10,000 salary increase helped ease my financial woes. I felt like I could breathe easy again. A few months later, I gave myself the best Christmas present ever: I paid off the remainder of my student loans. What I Learned E.M. Forster said, “We must be willing to let go of the life we have planned, so as to have the life that is waiting for us.” I’ve tried to adopt that as my mantra, even when it seems impossible to let go of my expectations. Responsible financial decisions, like shacking up in your high school bedroom to save money, or taking an underpaying job that will eventually enhance your career, are not always easy. Going home after graduation is not something that I am necessarily proud of, even in hindsight. On my lowest days, I wonder what opportunities I missed in both my personal life and my career by living with my parents. Yet I also know that I gained a lot, financially and emotionally, from my time at home. I developed a real, adult relationship with my parents. They’re no longer just Mom and Dad (or worse, a bank account). They’re friends. I started dating someone who also lived at home, whom I would not have met if I had moved straight to New York. I saved up enough money to pay off my loans and build my own emergency fund. (Here’s more on emergency funds.) Even now, I still worry about my finances, my career, my living situation. I don’t think I would be a normal 20-something year old if I didn’t. Living at home was not the path I thought I would take, but looking back, I wouldn’t trade it for a crappy apartment of my own, two years earlier.  Three years ago, my children and I moved to Utah County from Salt Lake County. Doing so made it more difficult for me to mentor single mothers at People Helping People in Salt Lake. Recently I found out that they are expanding into Utah County which will make it much easier for me to work with them again. It is very exciting because I know all the good they have done in Salt Lake County and now I will be able to be a part of something great again. You may be asking the question, “What makes them so great?” Before I answer that question, let me tell you a bit about why they exist. People Helping People is dedicated to reducing the number of children living in poverty by teaching low-income women, primarily single mothers, how to earn a living wage. So what is a living wage? A living wage is calculated off of the self-sufficiency standard which is calculated according to where you live and takes into account how many people are living in your home, housing costs, food, taxes, and other essential living expenses. The self-sufficiency standard for Utah can be found here: http://www.selfsufficiencystandard.org/docs/Utah%202001.pdf. What it says is that, assuming you have an average size family with three children, and you are a single parent, you would need to earn $46,000 per year in order to sustain your little family without the help of government programs, church, or family assistance. Unfortunately, there are over 6,000 single moms in Utah County and 75% of them and their children live below the self-sufficiency standard. Half of this group (38%) live below the poverty line. That is why I am so excited that People Helping People is expanding into Utah County. PHP’s Employment Program offers a unique, long term, one-on-one approach that teaches women how to get a good job, and seek and receive pay raises and promotions. In other words, they teach these women how to play the game of work. Utah is well known for its stay at home wife and mother population. It is also getting better known for it’s rising divorce rates. So it just makes sense to teach women how to earn a good living and be self-sufficient. If you or someone you know is a single mother and could benefit from learning what People Helping People has to offer, please join us on October 3rd or 17th for a program overview. After which, workshops will be held each Wednesday starting in October at Utah Valley University (UVU) at 723 S. 1200 W. in Orem. Other dates are listed in the image below. To quote Kayleen Simmons, “If you have to work, you may as well make it pay.” Join us to learn how. For more informaiton about People Helping People or to see schedules for Salt Lake and Weber Counties, go to: http://www.phputah.org/ or call Marva Sadler at 1.855.303.5300 or email her at [email protected]

In life, crazy things happen. Sometimes they are happy crazy things, sometimes they are sad. Sometimes they make you jump for joy, sometimes they make you mad. One thing that I have learned is that my reaction to the things that happen to me makes all the difference in the world. I will use Monday night as an example. As I was cooking dinner, I opened the microwave to soften some butter and the whole wall of cabinets toppled over onto

the floor, microwave and all. There are a few ways that I could have reacted to this. One is getting so angry that I could have been cussing up a storm and on the phone with lawyers right away wanting restitution for the damages. After all, my kitchen was a big reason that I bought my home. Another way I could have reacted is taking the victim role and playing the poor me card. So how did I react? First I yelled because it scared the pajeebers out of me. Then, once I realized what had happened, I got down on my knees and thanked the Lord that my children were outside playing and did not get hurt. Lastly, I felt the need to share my shock with friends so I took pictures and posted them on Facebook and called my father to see if he could help me fix it. Later when I took my girls out to dinner since dinner was ruined by chunks of drywall falling in it I received the best complement I could have ever received. My oldest daughter said to me, “Mom, you don’t seem very upset about the cabinets falling because you have stayed so calm.” All that I could think to say to that is, “No one got hurt so what is there to be upset about.” As I was saying it and after I had some time to think about that conversation I realized that a few years ago, I may not have been so calm. In fact, I would have probably gotten very angry. One thing that I have noticed about myself is that my anger is a secondary emotion. When I get angry it is usually covering up another emotion that I do not want to show anyone else. In a situation like the cabinets, my anger would have come from the fear of not being able to pay for the damages. Luckily my father kindly reminded me that something like this should be covered in my home owner’s insurance, which it is. In other situations, my anger comes from fear of one of my children getting hurt, or from feeling disrespected. In fact, those two emotions alone, fear and the feeling of being disrespected, are where I would say that 95% of my anger comes from. I haven’t quite figured out where the other 5% comes from but I am still learning about myself every day. So how do you think you would have reacted? Would you have taken the victim role and become paralyzed to do anything? Would you have become an anger ball and alienated everyone around you? Or would you have gotten down on your knees and thanked the Lord (or whoever you pray to) for your families safety? I know this sounds fake and absolutely ridiculous but I am thankful that this happened this week. After all, I just finished all my school work last week. Had it happened any earlier I would have been much more stressed about when I would be able to find time to take care of the situation. I am also in my spring cleaning mode, so what better way to clean out my cabinets then have all the stuff fall out of them for me? LOL. I know life can be stressful but my hope for you is that you can find the things to be thankful for so that you can take on a better perspective and show your children how to make the best of any situation. Until next time, God Bless! |

Archives

December 2019

Categories

All

|

RSS Feed

RSS Feed